Energy Transfer to Acquire Enable Midstream in $7 Billion All-Equity Transaction

- All-equity, credit-accretive bolt-on acquisition

- Complementary assets with significant integration opportunities

-

Enhances midstream infrastructure with increased connectivity throughout Mid-Continent and

U.S. Gulf Coast - Adds investment grade credit profile and diversified asset base anchored by strong customers and fee-based contracts

-

$100 million of operational / cost synergy opportunities expected, excluding additional upside from potential financing and commercial synergies

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210217005332/en/

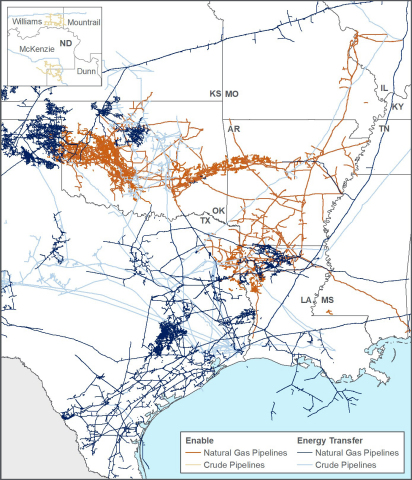

Complementary Asset Base Drives Value Across Footprint – Creates Contiguous Asset Footprint (Graphic: Business Wire)

Positive Financial Impact

The transaction furthers Energy Transfer’s deleveraging efforts as it is expected to be immediately accretive to free cash flow post-distributions, have a positive impact on credit metrics and add significant fee-based cash flows from fixed-fee contracts.

The all-equity nature of the transaction allows unitholders of both partnerships to participate in the value creation potential of the combined partnership.

Complementary Assets

Energy Transfer’s acquisition of Enable will increase Energy Transfer’s footprint across multiple regions and provide increased connectivity for Energy Transfer’s natural gas and NGL transportation businesses.

Energy Transfer will significantly strengthen its NGL infrastructure by adding natural gas gathering and processing assets in the

Enable’s transportation and storage assets enhance Energy Transfer’s access to core markets with consistent sources of demand and bolster its portfolio of customers anchored by large, investment-grade customers with firm, long-term contracts. Energy Transfer will further enhance its connectivity to the global LNG market and the growing global demand for natural gas as the world transitions to cleaner power and fuel sources.

Synergies

The combination of Energy Transfer’s significant infrastructure with Enable’s complementary assets will allow the combined company to pursue additional commercial opportunities and achieve cost savings while enhancing Energy Transfer’s ability to serve customers.

Energy Transfer expects the combined company to generate more than

Timing and Conference Call Information

The transaction has been approved by the Board of Directors of ET and the Conflicts Committee and the Board of Directors of Enable. The two largest unitholders of Enable, OGE Energy Corp. (“OG&E”) and

Energy Transfer will host a conference call

Advisors

About Energy Transfer

About Enable

Forward-Looking Statements

This release includes “forward-looking” statements. Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may” or similar expressions help identify forward-looking statements. Energy Transfer and Enable cannot give any assurance that expectations and projections about future events will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. These risks and uncertainties include the risks that the proposed transaction may not be consummated or the benefits contemplated therefrom may not be realized. Additional risks include: the ability to obtain requisite regulatory and stockholder approval and the satisfaction of the other conditions to the consummation of the proposed transaction, the ability of Energy Transfer to successfully integrate Enable’s operations and employees and realize anticipated synergies and cost savings, the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers, competitors and credit rating agencies, the ability to achieve revenue, DCF and EBITDA growth, and volatility in the price of oil, natural gas, and natural gas liquids. Actual results and outcomes may differ materially from those expressed in such forward-looking statements. These and other risks and uncertainties are discussed in more detail in filings made by Energy Transfer and Enable with the

Additional Information and Where to Find It

SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION CAREFULLY WHEN IT BECOMES AVAILABLE. These documents (when they become available), and any other documents filed by Energy Transfer and Enable with the

No offer or solicitation

This communication relates to a proposed merger (the “Merger”) between Enable and Energy Transfer. This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Merger or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

Enable, Energy Transfer, and the directors and executive officers of their respective general partners, CNP (and their affiliates), OGE (and their affiliates) may be deemed to be participants in the solicitation of proxies in respect to the Merger.

Information regarding the directors and executive officers of Enable’s general partner is contained in Enable’s 2019 Annual Report on Form 10-K filed with the

Investors may obtain additional information regarding the interests of those persons and other persons who may be deemed participants in the Merger by reading the consent solicitation statement/prospectus regarding the Merger when it becomes available. You may obtain free copies of this document as described above.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210217005332/en/

Investors

(214) 981-0795

investorrelations@energytransfer.com

Media

(214) 840-5820

media@energytransfer.com

Investors

(405) 558-4600

Media

(405) 553-6947

Source: